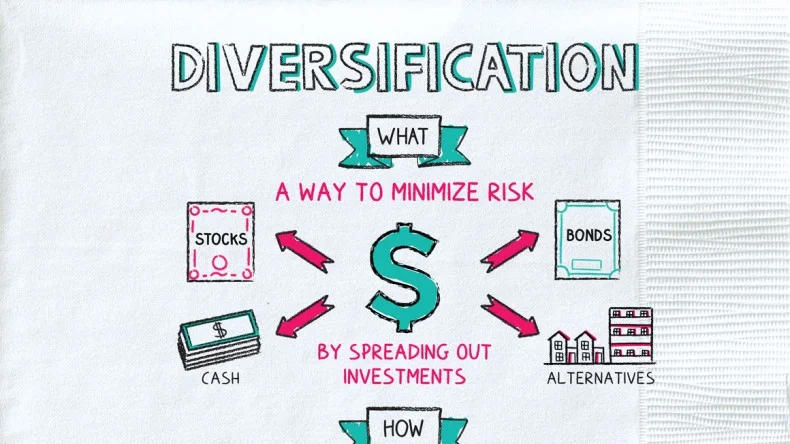

Diversification is one of the core principles of successful investing, yet it is often misunderstood or overlooked by beginners. At its simplest, diversification means spreading your investments across various asset classes, industries, and geographic regions. The purpose is to reduce risk by ensuring that no single investment can significantly harm your overall portfolio. Markets are unpredictable, and even the strongest companies or sectors can underperform during economic shifts. Without diversification, your financial success becomes dependent on the performance of a limited set of assets. Diversification protects your portfolio from volatility, balances returns, and creates a more stable pathway toward long-term financial growth.

Key reasons diversification is essential:

-

Reduces overall investment risk

-

Minimizes the impact of market downturns

-

Balances performance across different economic cycles

-

Offers more consistent long-term returns

-

Helps protect your investments from unexpected events

Types of Diversification and How Each One Works

Diversification can be implemented in several ways, and understanding each type allows you to build a stronger, more resilient investment portfolio. The most common form is asset-class diversification, which involves spreading investments across stocks, bonds, real estate, commodities, and cash equivalents. Each asset class performs differently depending on economic conditions. For instance, stocks may rise during strong economic periods, while bonds may perform better during market uncertainty.

Another effective strategy is industry diversification, which involves investing in multiple sectors such as technology, healthcare, finance, energy, and consumer goods. Economic disruptions often affect industries differently. If one sector experiences losses, another may remain stable or even grow. Geographic diversification also plays a key role. By investing internationally, you reduce dependence on one country’s economic performance. Markets in Asia, Europe, and emerging economies often move independently from U.S. or local markets, creating new opportunities for growth.

Finally, diversification by investment vehicle—such as owning a mix of individual stocks, index funds, ETFs, and bonds—ensures that your portfolio benefits from different investment structures. Index funds and ETFs already provide built-in diversification by pooling many assets together, making them ideal for beginners.

Advantages of each diversification type:

-

Asset-class diversification: Protects against volatility in any single market

-

Sector diversification: Reduces industry-specific risks

-

Geographic diversification: Minimizes country-specific economic challenges

-

Investment-vehicle diversification: Offers flexibility, lower risk, and balanced growth

How to Build a Diversified Portfolio Step by Step

Creating a diversified portfolio does not require expert knowledge or large capital. The process begins with determining your risk tolerance. If you are a conservative investor, you may choose more bonds and fewer stocks. If you are aggressive, you may lean heavily toward stocks and growth-oriented assets. Once your risk profile is established, begin selecting assets across a mixture of categories.

Most beginners start with broad-market index funds or ETFs because these funds automatically diversify across hundreds of companies. You can then add bonds or bond ETFs to create stability. If you want more exposure, consider including international funds or emerging-market ETFs. Real estate investment trusts (REITs) provide property market exposure without the need to buy physical real estate. Over time, you can expand your portfolio by adding sector-specific ETFs or a limited number of individual stocks to balance growth and stability.

Maintaining diversification requires periodic rebalancing. As markets change, some investments grow faster than others, causing your portfolio to shift away from your original risk balance. Rebalancing—usually once or twice per year—realigns your portfolio back to its intended structure by selling a portion of overweight assets and reinvesting in underweighted ones.

Practical steps to diversify effectively:

-

Determine your risk tolerance and long-term financial goals

-

Begin with broad index funds or ETFs for automatic diversification

-

Mix asset classes (stocks, bonds, REITs, cash equivalents)

-

Add international or emerging-market exposure

-

Review and rebalance your portfolio annually

-

Avoid overconcentration in any single asset or sector

Why Diversification Leads to Better Long-Term Results

Diversification works because no one can predict the market with perfect accuracy. Even professional investors and analysts cannot consistently forecast which sectors or assets will outperform. By diversifying, you reduce reliance on luck, timing, or speculation. Instead, your portfolio benefits from the average performance of a wide range of assets. Historically, diversified portfolios outperform non-diversified portfolios on a risk-adjusted basis. This means you achieve smoother returns with less volatility and fewer emotional decision-making triggers.

Long-term investors benefit significantly from diversification because it supports consistent growth through various market cycles. When one asset declines, another often rises. This balance keeps your portfolio steady, allowing compounding to work more effectively. Diversification also helps prevent panic selling, which is one of the most common mistakes investors make during market downturns. With a diversified portfolio, you gain confidence that temporary declines will be offset by other strong-performing assets.

Long-term advantages of diversification:

-

More stable and predictable growth

-

Reduced emotional stress during market volatility

-

Enhanced compounding over time

-

Better protection against recessions and downturns

-

Improved risk-adjusted returns compared to concentrated portfolios